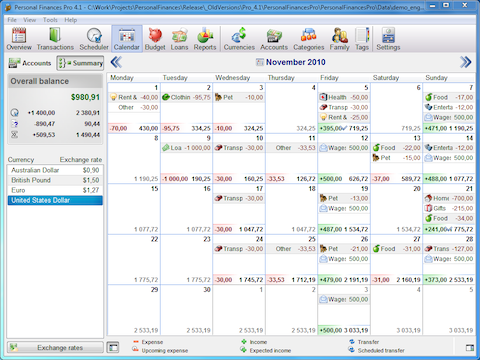

A Different Kind of DashboardĮvery service reviewed here has a dashboard, or home page, that you see when you first log in. Quicken's dashboard lets you see your income and expenses. Moneydance, too, is good at transaction management, but Quicken Deluxe tops all rivals. CountAbout and others go a step further, providing additional tools that let you designate selected transactions as recurring, for example. In those circumstances, you can manually create a transaction. If you bought something with cash, though, your bank won't have a record of it. That way, you can search for transactions that are related in ways other than category assignments. This information can also be helpful when tax preparation time rolls around.ĭepending on the service, you might be able to add transaction tags. If you're conscientious about this, you'll see charts and reports that accurately tell you where you're earning and spending your money. Most personal finance apps guess the appropriate categories, but you can always change it-and you can split transactions among different categories. For example, transactions need to be correctly categorized as income (salary, freelance payment, and interest, for example) and expenses (food, mortgage, utilities, and so on).

Once you import a batch of transactions, you will probably spend some time cleaning up the data. Typically, you simply enter your login credentials for those financial sites, though occasionally you have to provide additional security information.

#Best free personal finance software reviews 2018 download

That is, you can download cleared transactions and other account data from your banks, credit card providers, brokerages, and other financial institutions, and see all of it neatly displayed in the applications' registers. For example, most of them support online connections to your financial institutions. Best Hosted Endpoint Protection and Security SoftwareĪll the applications we reviewed have new features, but they share common characteristics.

0 kommentar(er)

0 kommentar(er)